DECODING THE SUBJECT

The ACCA Financial Management or ACCA FM course helps you develop the knowledge and skills expected of a Finance Manager in relation to investment, financing, and dividend policy decisions. The primary objective of every Finance Manager is the maximization of shareholders’ wealth. They often come across questions like what is the economic environment of the business, what are the different investment opportunities available, how to manage working capital, what are the different sources of finance available, how to manage risk, and so on.

Being an exam in the skills level, ACCA FM can be attempted during any of the four exam sessions throughout the year – March, June, September or December. Qualifying this exam and the ones that precede this can confer upon you the Advanced Diploma in Accounting & Business (provided you have completed your ethics & professional skills module). You can read more about it here.

Table Of Contents

ACCA FM SYLLABUS

ACCA FM PAPER PATTERN

ACCA FM PASSING TRENDS

SOURCES OF CONTENT

STUDYING METHODOLOGY

HOW TO PLAN ACCA FM MOCK EXAMS

THINGS TO REMEMBER WHILE WRITING THE EXAM

EXAMINER’S EXPECTATIONS

ACCA FM SYLLABUS

The syllabus for ACCA FM is comprehensively designed to equip candidates with the skills that would be expected from a finance manager responsible for the finance function of a business. It prepares candidates for more advanced and specialist study in Advanced Financial Management. Here is the detailed syllabus-

A. Financial Management Function

A. Financial Management Function

- The nature and purpose of financial management

- Financial objectives and relationship with corporate strategy

- Stakeholders and impact on corporate objectives

- Financial and other objectives in not-for- profit organisations

B. Financial Management Environment

B. Financial Management Environment

- The economic environment for business

- The nature and role of financial markets and institutions

- The nature and role of money markets

C. Working Capital Management

C. Working Capital Management

- The nature, elements and importance of working capital

- Management of inventories, accounts receivable, accounts payable and cash

- Determining working capital needs and funding strategies

D. Investment Appraisal

D. Investment Appraisal

- Investment appraisal techniques

- Allowing for inflation and taxation in DCF

- Adjusting for risk and uncertainty in investment appraisal

- Specific investment decisions (lease or buy, asset replacement, capital rationing)

E. Business Finance

E. Business Finance

- Sources of, and raising, business finance

- Estimating the cost of capital

- Sources of finance and their relative costs

- Capital structure theories and practical considerations

- Finance for small- and medium-sized entities (SMEs)

F. Business Valuations

F. Business Valuations

- Nature and purpose of the valuation of business and financial assets

- Models for the valuation of shares

- The valuation of debt and other financial assets

- Efficient market hypothesis (EMH) and practical considerations in the valuation of shares

G. Risk Management

G. Risk Management

- The nature and types of risk and approaches to risk management

- Causes of exchange rate differences and interest rate fluctuations

- Hedging techniques for foreign currency risk

- Hedging techniques for interest rate risk

H. Employability and technology skills

H. Employability and technology skills

- Use computer technology to efficiently access and manipulate relevant information

- Work on relevant response options, using available functions and technology, as would be required in the workplace

- Navigate windows and computer screens to create and amend responses to exam requirements, using the appropriate tools

- Present data and information effectively, using the appropriate tools

Hack: Keeping in mind that all the topics are equally important. It is suggested that you start first with Part B: Investment Appraisal -> then Part C: Working Capital -> followed by Part D: Business Finance and Cost of Capital -> and Part E: Business Valuations. This ensures you have covered a major chunk of the syllabus leaving enough time to focus on Part F: Risk management. Part A: The financial management environment and function is purely a theory topic that you can leave for the end.

ACCA FM PAPER PATTERN

The 100-marks ACCA FM exam paper has been designed to ensure that all the different areas of the syllabus are covered adequately. Following are the various sections and question types that you can expect-

| ACCA Financial Management (100 Marks) | ||

|---|---|---|

| Section A (30 marks) | Section B (30 marks) | Section C (40 marks) |

| 15 OTQ’s * 2 marks each | 3 case studies * 5 OTQ’s in each case study * 2 marks each | 2 Constructed response questions * 20 marks each |

Hack: Solve all questions from the Practice Kit to ensure different styles of questions are covered. To pass with flying colors, the practice kit should be solved a minimum of 2-3 times.

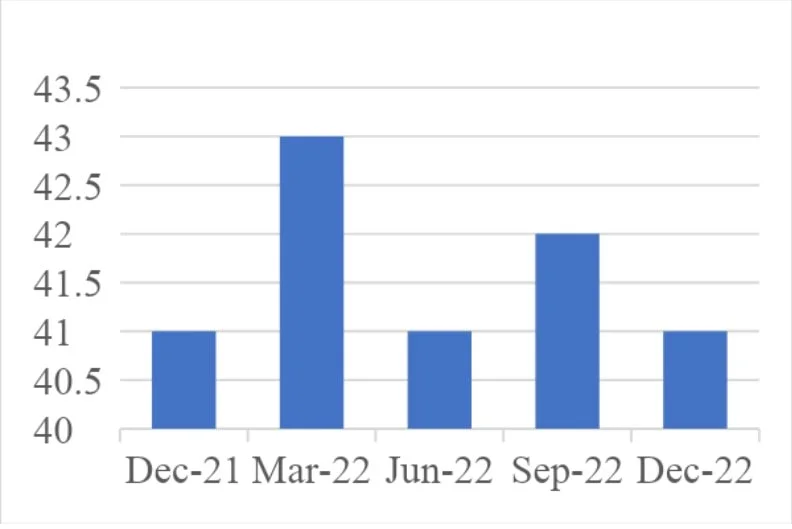

ACCA FM PASSING TRENDS

You are expected to score 50/100 to pass this examination. This is easily manageable with a clear understanding of the concepts, good practice of the questions and a positive attitude. The pass rates of ACCA FM paper across the globe are roughly between 45%-55% for most attempts.

SOURCES OF CONTENT

You need to primarily refer to these two content sources for your preparations –

- The Study Text – for conceptual understanding

- The Practice/Exam Kit – for practice questions

There are only two ACCA-approved content providers that you should consider, namely, Kaplan Publishing and BPP Learning Media. Apart from this, you can also refer to the technical articles published by ACCA on different topics. You can use this link to refer to the articles-

Download our curated express notes for ACCA FM here

STUDYING METHODOLOGY

- Start with the Study Text and go through all the concepts thoroughly. Later, try solving questions from the Practice Kit to get more clarity and a deeper understanding of how to apply these concepts.

- Focus more on really important areas say, for example, Investment Appraisal (Net Present Value), Cost of Capital (Weighted Average Cost of Capital), Business Valuation, and Risk Management (Money Market Hedge).

- Spend enough time on understanding and doing the theory well rather than focusing only on numbers. In the Financial Management exam, along with the practical questions, there are also a good number of theory questions to test your ability to explain the concepts well.

- While solving the constructed response questions from the Practice Kit, it is useful to go through the key answer tips, tutor’s top tips, tutorial notes, and examiner’s comments along with the solutions.

- Practice a few constructed response questions using basic features of MS Word and MS Excel too. Also, you can use the constructed response ‘blank workspace’ provided by the ACCA after logging in to the Practice Platform to get a hold of the CBE environment. You can follow through this link.

- You should be able to demonstrate the knowledge gained from studying technical concepts and be able to explain the theoretical concepts well during the examination.

HOW TO PLAN ACCA FM MOCK EXAMS

Attempting enough mock exams are a must! Going without solving mocks is like a soldier without a weapon.

The examination is now conducted using the CBE platform, it is truly important to write at least 2-3 mocks to get a good idea of how the final examination would be and to get used to the CBE environment.

You can log in to the ACCA ‘Practice Platform’ for solving mocks using the following link.

Hack: One day before the examination, invest all your time in revising what you have studied so far. Do not try to study any new concept or solve any new problem. Skim through the study text and practice kit to focus on memorizing the important concepts, theory topics, and formulas if required. Have a look at the formulae sheets & maths tables (link) that you will be provided with during the exam.

THINGS TO REMEMBER WHILE WRITING THE EXAM

After months of all the efforts and hard work you would’ve put into the preparation for this exam, it is equally important to ace your exam. Here are some things to remember-

- Time Management: It is important to complete the paper on time. Remember, time management is a key to success! Here is how you can allocate your time-

| PAPER | FM | TOTAL |

|---|---|---|

| Section A | 15 OTQ’s * 2.67 mins | 40 minutes |

| Section B | 15 case study OTQ’s * 2.67 mins | 40 minutes |

| Section C | 2 questions * 45 mins each | 90 minutes |

| Final check | 10 minutes | |

| TOTAL | 180 minutes |

- Do not stress or panic during the exam, stay calm write all you know. If you freak out, it is possible that you mess with other straightforward, manageable, and scoring questions.

- Do not leave any question unattempted

- For your OTQ’s there is always a 25% probability to get the answer right, place your bet and mark the option you believe is the closest to the answer.

- For constructed response questions there is no negative marking. So, based on your understanding of the concepts make sure you form an answer to every question asked.

- Be prepared to find different and new styles of questions, with patience and linking to the concepts of your syllabus you should be able to tackle them well.

- Better to start with Section A first, then Section B, and lastly Section C, i.e. FOLLOW THE ORDER! Do not spend too much time finding answers to questions you are not able to crack. Section C: make sure for the numerical questions you show the workings along with the solution wherever needed For theoretical questions write enough to earn marks. One healthy and valid point is worth 1 mark.

EXAMINER’S EXPECTATIONS

The ACCA publishes an Examiner’s Report for every attempt which gives an insight into the marking process, the common mistakes that students make during the exams, and other useful techniques to do well in your examination. You must go through the Examiner’s Reports to understand what the examiner is expecting from you. It will help you understand how students have failed to tackle different questions and how they could have performed better. It’s like learning from someone else’s mistakes. You can follow through this link to refer to a few of the examiner’s reports published by the ACCA.

All the best 😊

Our expert tutors for ACCA Financial Management (ACCA FM) have successfully coached thousands of ACCA aspirants with a phenomenal passing rate. Over 92% of our students that completed our full eLearning program passed their exams (92% was an average of all our qualification courses over the last 2 years at the time of writing). Join their club with our Platinum Rated ACCA Online Courses today! Book a demo.

Summary of all links

Technical articles published by ACCA

Blank workspace provided by the ACCA

Formulae sheets & Maths tables

Examiner’s reports published by the ACCA