ACCA Syllabus 2024: A Complete Study Guide

Are you ready to hop on the bandwagon and join one of the highest-paying qualifications globally: ACCA? Let us congratulate you on this great decision. The ACCA has developed a robust framework to cultivate strategic thinking ethically minded, and knowledgeable financial professionals worldwide. But if you are wondering where to start and what the ACCA syllabus will be in 2024, we have a comprehensive guide for you.

To know the ACCA Qualification updates, check out the video below:

Table of Contents

Introduction To ACCA

The first thing you should be aware of at this stage is, what is ACCA? To briefly describe it, established in 1904, the Association of Chartered Certified Accountants (ACCA) is a global leader in professional accounting. The ACCA offers the prestigious Chartered Certified Accountant qualification to 240,952 current members and 541,930 aspiring members worldwide. Thus, the joining criteria for such an outstanding course need to be understood deeply, and accordingly, you can opt for the best options to take the ACCA Qualification course.

ACCA Eligibility Criteria

The first step to joining the ACCA course is, of course, registration! To register for the ACCA qualification, you must have:

Standard Entry:

– Complete your 10+2 examinations.

– Achieve at least 65% in Mathematics/Accounts and English.

– Secure a minimum of 50% in other subjects.

Alternative Entry via Foundation in Accountancy (FIA):

– Applicable if you have completed class 10 or must meet the standard entry requirements.

– It allows you to start with the FIA route to progress towards the ACCA qualification.

Unveiling the ACCA Syllabus: A Detailed Guide

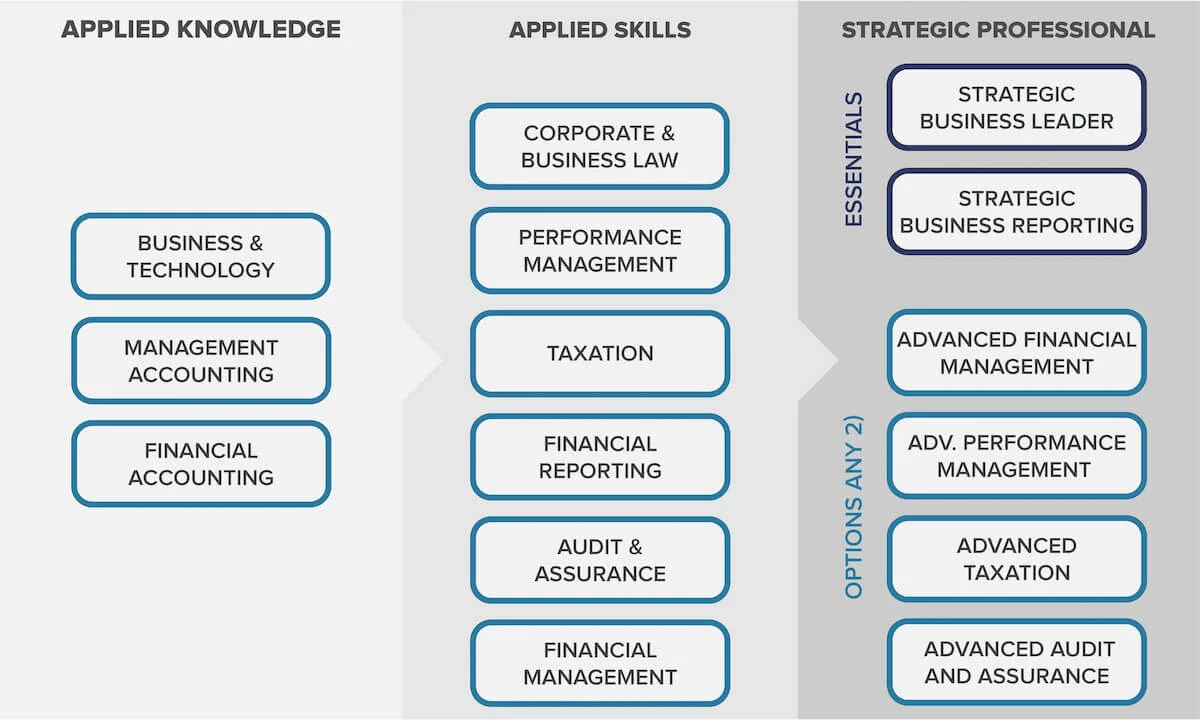

The ACCA syllabus consists of three levels: the Knowledge level, Skills level, and professional level. You will grasp accounting, business, and ethics principles through these thorough levels. These Levels comprise two sections with nine exam modules, which you can read below:

ACCA Course Structure

Knowledge Level

– Business and Technology (BT)

– Management Accounting (MA)

– Financial Accounting (FA)

Skill Level includes

– Corporate and Business Law (LW)

– Performance Management (PM)

– Taxation (TX)

– Financial Reporting (FR)

– Audit and Assurance (AA)

– Financial Management (FM)

Please Note: According to the latest updates in ACCA qualification, if you are an undergraduate or graduate, you can enroll in an accredited BCom program or its variants from a state or central university and can get up to 5 exemptions (BT, MA, FA, LW & TX) after submitting your 1st Semester Marksheet.

Knowledge Level

If you are curious to know what exactly is included in the knowledge level, the Applied Knowledge Level exams provide a comprehensive introduction to accounting and finance. The ACCA syllabus helps you develop a fundamental understanding of accounting practices and methods. The foundational knowledge you gain at this stage will prepare you for more advanced subjects.

This level of Applied Knowledge examination contains 100% obligatory questions that help you cover the full spectrum of each ACCA syllabus. During this phase, you will prepare for the intricacies of finance, from corporate and business law to performance management.

The three examinations under the ACCA course subjects for this level are:

Business and Technology (BT)

Business and Technology teach how businesses operate effectively, efficiently, and ethically, showcasing finance professionals’ critical role. You’ll understand business in the context of its environment with the economic, legal, and regulatory influences on aspects like governance, employment, health and safety, data protection, and security.

Management Accounting (MA)

Acquire skills in management accounting to effectively support businesses in planning, controlling, and monitoring performance. Here, you will explore diverse financial management strategies to optimize business performance.

Financial Accounting (FA)

Learn the underlying principles and concepts of financial accounting, accounting techniques, and the preparation of basic financial statements. Demonstrate technical proficiency in double-entry techniques. This will include preparing and interpreting basic financial statements for sole traders, partnerships, companies, and simple groups of companies.

Skills Level

Skills Level exam modules or papers build upon the knowledge gained during the previous level. They help you understand applications, develop a solid financial understanding, and develop the ability to be a business and finance professional across industries or sectors globally.

The six examinations under this ACCA course subject list are:

Corporate and Business Law (LW)

You will gain proficiency in understanding general legal frameworks and specific business-related legal areas. You will also master the importance of seeking specialized legal advice as needed.

Performance Management (PM)

With this exam, you will master management accounting techniques, seamlessly integrating quantitative and qualitative information. These will help you plan better, enhance your decision-making skills, build more robust performance evaluations, and take control whenever required.

Taxation (TX)

You’ll develop knowledge and skills related to the tax system as it applies to individuals, single companies, and groups of companies.

Financial Reporting (FR)

Gain proficiency in understanding accounting standards and theoretical frameworks. Learn how to effectively prepare financial statements for entities, including groups, and master the analysis and interpretation of these statements.

Audit and Assurance (AA)

You’ll develop knowledge and understanding of the assurance engagement process and its application in the professional regulatory framework.

Financial Management (FM)

Develop the knowledge and skills expected of a finance manager with investment, financing, and dividend policy decisions.

Professional Level

Now, let us understand what’s in store for you at the Professional Level of the ACCA course structure! The professional level includes two main categories: Essentials and Options. This module closely mirrors the structure of post-graduation degrees and focuses on augmenting your technical skills. It also provides exposure to advanced professional skills, values, and techniques by professional accountants with advisory roles at a senior executive level.

To excel in leadership roles, you need more than the foundational knowledge provided by the Knowledge & Skill Level modules. With a well-designed curriculum, the Strategic Professional Level exams prepare you for future leadership positions by enhancing your technical, ethical, and professional skills. This level includes six papers, with two being compulsory and four optional. Students select specializations from FM, PM, TX, and AA that align with their career goals.

Essential Papers

Strategic Business Leader (SBL)

You will demonstrate your technical, ethical, and professional skills in evaluating, synthesizing, and presenting a case study.

Strategic Business Reporting (SBR)

This program elevates reporting to a new level. You will gain the skills needed to confidently speak the language of business and explain reports to various stakeholders.

Optional Papers (any 2)

Advanced Financial Management (AFM):

Develops advanced skills in financial management, including investment decision-making, risk management, and strategic financing options.

Advanced Performance Management (APM):

It focuses on advanced performance management techniques and strategies, making it ideal for roles in management accounting, performance optimization, and consultancy.

Advanced Taxation (ATX):

It covers complex taxation issues, corporate tax planning, international taxation, and the tax implications of business decisions. It is suitable for roles in tax advisory and senior compliance.

Advanced Audit and Assurance (AAA):

Deals with high-level auditing practices, including strategic analysis and critical auditing standards within a global framework.

EPSM Module

After clearing modules at both levels, you must dedicate 20 hours to the Ethics and Professional Skills Module (EPSM). This module, featuring case studies and exposure to real-world business situations, aims to enhance the trustworthiness and credibility of ACCA candidates.

Sequentially attempt the exam modules, starting with Applied Knowledge, progressing to Applied Skills, and concluding with the Strategic Professional modules. The Ethics and Professional Skills Module becomes available after completing the Applied Knowledge exams.

Excel ACCA Syllabus With Synthesis Learning

At Synthesis Learning, we pride ourselves on the best ACCA coaching with our innovative approach to education. We’ve designed a precise four-step process to ensure that our ACCA students not only master the syllabus but also excel in their professional careers. Here’s how we do it:

Counseling:

We start with personalized sessions to understand your career goals and educational needs.

Mentoring:

You’ll receive guidance from experienced professionals who’ve been where you want to go.

Coaching:

Our targeted coaching methods ensure you grasp complex concepts effectively.

Placements:

We don’t just educate; we also help place you in roles that fit your new qualifications.

Why Choose Us as Your Learning Partner?

Platinum Approved Learning Partner:

Synthesis Learning is recognized as a Platinum Approved Learning Partner, the highest accreditation by ACCA, signifying our commitment to delivering exceptional education standards.

Highest Accreditation by ACCA:

Being a Platinum Rated partner means we meet the rigorous standards of ACCA for educational excellence.

High Student Outreach:

Our programs are designed to reach many students, ensuring accessibility and inclusivity in learning.

Exceptional Pass Rates With Global Rankers:

We boast impressive pass rates and have a history of our students achieving global ranks, demonstrating the effectiveness of our teaching methods.

Conclusion

The ACCA qualification offers guidance towards becoming a seasoned professional capable of making solid impacts in the finance world. Each step of the ACCA journey builds upon the last, culminating in a robust understanding of finance and business’s technical and ethical aspects. With Synthesis Learning’s support, get equipped to achieve your ACCA qualifications with the best results and make way for a successful and fulfilling career in accounting and finance.

Get In Touch

Looking to accelerate your career in ACCA? Connecting with us is super easy and hardly takes a minute! Just call 9320007893/96, and we will help you design a comprehensive ACCA journey.