Understanding ACCA Syllabus – Knowledge Level

The Basics

Since its inception in 1904, the Association of Chartered Certified Accountants (ACCA) has been a global leader in professional accounting. With 240,952 current members and 541,930 aspiring members worldwide, ACCA offers the prestigious Chartered Certified Accountant qualification. In today’s fiercely competitive business landscape, ACCA stands as a pivotal force in shaping successful careers.

To know the ACCA Qualification updates, check out the video below:

ACCA Syllabus

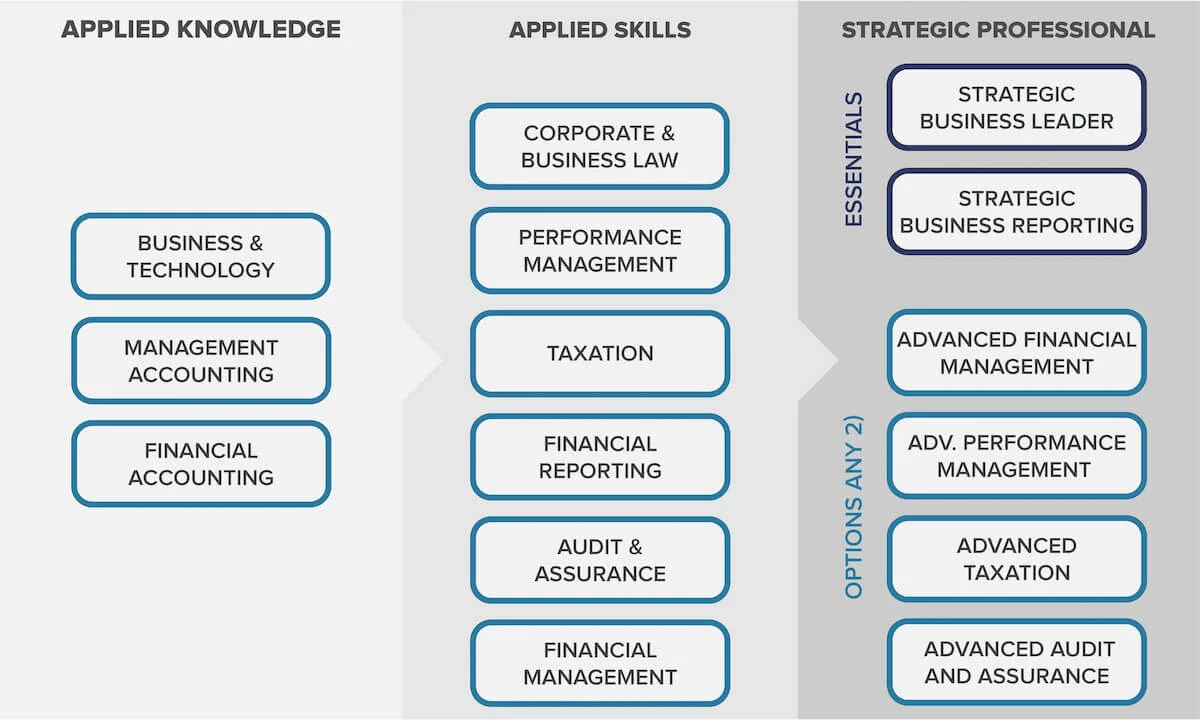

The ACCA journey is a three-stage ascent. Knowledge Level: Build your base with core accounting knowledge. Skills Level: Sharpen your skills, wielding finance like a pro. Professional Level: Conquer the peak, specializing and becoming a true strategic thinker. The ACCA syllabus – your map to the summit of accounting expertise. Climb smart, climb strong!

Lets Explore the foundations of finance and accounting through the comprehensive Applied Knowledge exams, gaining a broad understanding of crucial accounting techniques.

These exams, though foundational, are not to be underestimated. They lay the groundwork for your entire accounting career, building the solid knowledge base you’ll rely on throughout your studies and professional practice. But fear not, future accountant! With the right approach and resources, you can ace these exams and confidently move on to the next stage.

Business and Technology (BT)

Business and Technology teach how businesses operate effectively, efficiently, and ethically, showcasing finance professionals’ critical role in this. You’ll understand business in the context of its environment, including economic, legal and regulatory influences on aspects like governance, employment, health and safety, data protection and security.

ACCA syllabus covered in Business and Technology (BT) September 2023 to August 2024:

1. The business organization and its external environment

- The purpose and types of business organization

- Stakeholders in business organizations

- Political and legal factors affecting business

- Macroeconomic factors

- Microeconomic factors

- Social and demographic factors

- Technological factors

- Environmental and sustainability factors

- Competitive factors

2. Organizational structure, culture, governance and sustainability

- The formal and informal business organization

- Business organizational structure

- Organizational culture

- Governance in business organizations

- Sustainable business practices

3. Business functions, regulation and technology

- The relationship between accounting and other business functions

- Accounting and finance functions within business organisations

- Regulation and financial crime

- Financial information provided by business

- Financial systems and technology

- Internal controls

- The impact of advances in technology

4. Leadership and management

- Leadership, management, and supervision

- Individual and group behavior’s in business organizations

- Team formation, development, and management

- Motivating individuals and teams

- Learning and training at work

- Review and appraisal of individual performance

5. Personal effectiveness and communication in business

- Personal effectiveness

- Consequences of ineffectiveness at work

- Competence frameworks and personal development

- Sources of conflicts and techniques for conflict resolution

- Communicating in business

6. Professional ethics

- Fundamental principles of ethical behaviour

- The role of regulatory and professional bodies in promoting ethical and professional standards in

- the accountancy profession

- Corporate codes of ethics

- Ethical conflicts and dilemmas

Pass rates for Business and Technology (BT) is 83% (June 2023).

Click here to download the syllabus and study guide for BT (September 2023 to August 2024.)

Management Accounting

Acquire skills in management accounting to effectively support businesses in planning, controlling, and monitoring performance. Explore diverse financial management strategies within an organization to optimize business performance.

ACCA syllabus covered in Management Accounting (MA) September 2023 to August 2024:

1. The nature, source and purpose of management information

- Accounting for management

- Sources of data

- Cost classification

- Presenting information

2. Data analysis and statistical techniques

- Sampling methods

- Analytical techniques in budgeting and forecasting

- Summarizing and analyzing data

- Spreadsheets

3. Cost accounting techniques.

- Accounting for material, labour and overheads

- Absorption and marginal costing

- Cost accounting methods

- Alternative cost accounting principles

4. Budgeting

- Nature and purpose of budgeting

- Budget preparation

- Flexible budgets

- Asset budgeting and investment appraisal

- Budgetary control and reporting

- Behavioural aspects of budgeting

5. Standard costing

- Standard costing system

- Variance calculations and analysis

- Reconciliation of budgeted and actual profit

6. Performance measurement

- Performance measurement – overview

- Performance measurement – application

- Cost reductions and value enhancement

- Monitoring performance and reporting

Pass rates for Management Accounting is 63% (June 2023).

Click here to download the syllabus and study guide for MA (September 2023 to August 2024.)

Financial Accounting

Learn the underlying principles and concepts of financial accounting, accounting techniques and the preparation of basic financial statements. You’ll demonstrate technical proficiency in double-entry techniques, including preparing and interpreting basic financial statements for sole traders, partnerships, companies and simple groups of companies.

ACCA syllabus covered in Financial Accounting (FA) September 2023 to August 2024:

1. The context and purpose of financial reporting

- The scope and purpose of financial statements for external reporting

- Stakeholders’ needs

- The main elements of financial reports

- The regulatory framework

- Duties and responsibilities of those charged with governance

2. Accounting principles, concepts and qualitative characteristics

- Key principles and concepts of accounting

- Qualitative characteristics of useful financial information

3. The use of double-entry and accounting systems

- Double-entry book-keeping principles including the maintenance of accounting records

- General ledger accounts and journal entries

4. Recording transactions and events

- Sales and purchases

- Cash

- Inventories

- Tangible non-current assets

- Depreciation

- Intangible non-current assets and amortisation

- Accruals expenses (accruals), prepaid expenses (prepayments), accrued income, and deferred income

- Receivables and payables

- Provisions and contingencies

- Capital structure and finance costs

5. Reconciliations

- Bank reconciliations

- Trade payables account reconciliations

6. Preparing a trial balance

- Trial balance

- Correction of errors

- Suspense accounts

7. Preparing financial statements

- Statement of financial position

- Statement of profit or loss and other comprehensive income

- Disclosure notes

- Events after the reporting period

- Statement of cash flows (excluding partnerships

- Incomplete records

8. Preparing basic consolidated financial statements

- Subsidiaries

- Associates

9. Interpretation of financial statements

- Importance and purpose of analysis of financial statements

- Ratios

- Analysis of financial statements

Pass rates for Financial Accounting is 72% (June 2023).

Click here to download the syllabus and study guide for FA(September 2023 to August 2024.)

Please refer to our Knowledge level FAQs Blog if you have any questions.

*Here is a chart showing ACCA Syllabus

The Unique Approach of Synthesis Learning

Synthesis Learning pioneers innovation in education, implementing a precise 4-step process covering counseling, mentoring, coaching, and placements. This strategic approach guarantees ACCA students’ thorough comprehension and professional skill development.

Watch our toppers testimonial and know how Synthesis Learning can help you achieve your goal.

Please reach out to us at 9320007893/96. We will help you design a comprehensive ACCA journey.

Conclusion

The ACCA Knowledge Level Exams may be the first hurdle on your accounting journey, but they are by no means insurmountable. By diligently approaching your studies, utilizing the wealth of resources available, and developing effective revision strategies, you can confidently conquer these exams and lay the critical foundation for a successful career in finance.

Remember, the knowledge and skills you acquire at this stage will serve you well throughout your professional life. Your understanding of core accounting principles, financial analysis techniques, and the broader business landscape will empower you to make informed decisions, solve complex problems, and navigate the ever-evolving world of finance with confidence.