The Basics

Since its inception in 1904, the Association of Chartered Certified Accountants (ACCA) has been a global leader in professional accounting. With 240,952 current members and 541,930 aspiring members worldwide, ACCA offers the prestigious Chartered Certified Accountant qualification. In today’s fiercely competitive business landscape, ACCA stands as a pivotal force in shaping successful careers.

To know the ACCA Qualification updates, check out the video below:

ACCA Syllabus

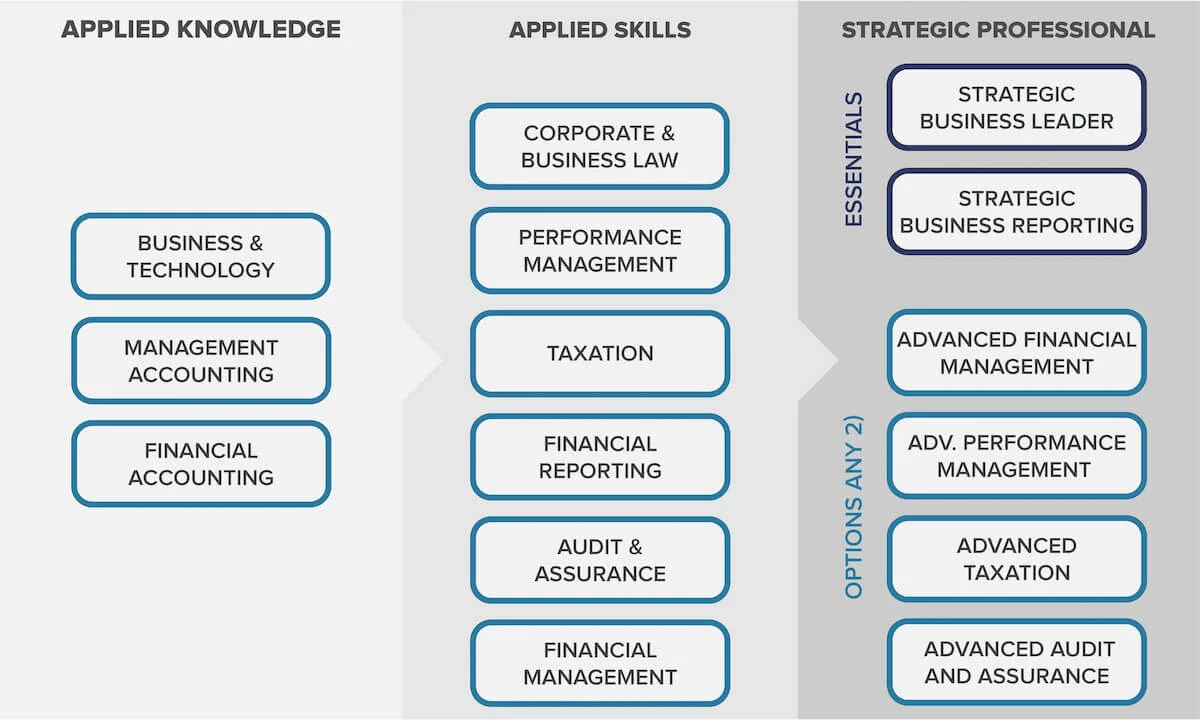

The ACCA journey is a three-stage ascent. Knowledge Level: Build your base with core accounting knowledge. Skills Level: Sharpen your skills, wielding finance like a pro. Professional Level: Conquer the peak, specializing and becoming a true strategic thinker. The ACCA syllabus – your map to the summit of accounting expertise. Climb smart, climb strong!

As professionals, it is crucial for individuals to possess a well-rounded skill set and a strong foundation of technical expertise. The Association of Chartered Certified Accountants (ACCA) recognizes this need and has developed a comprehensive syllabus for its professional level, known as Strategic Professional. This syllabus sets a new standard by fully integrating deep, broad, and relevant technical expertise with ethics and professional skills. By doing so, ACCA ensures that its students are well-prepared to handle the challenges they face in the workplace.

The ACCA Strategic Professional syllabus consists of two mandatory papers, Strategic Business Reporting (SBR) and Strategic Business Leader (SBL), along with two optional papers. The optional papers are chosen from four options: Advanced Financial Management (AFM), Advanced Performance Management (APM), Advanced Taxation (ATX), and Advanced Audit and Assurance (AAA). This allows students to tailor their studies according to their interests and career aspirations.

The six examinations under this level are as follows –

ACCA Syllabus for Professional Level:

Strategic Business Reporting (SBR)

Taking reporting to new levels, students will get the skills needed to confidently speak the language of business and explain reports to a wide variety of stakeholders.

The Strategic Business Reporting (SBR) exam requires you to demonstrate your ability to make strategic business reporting decisions. Set within the corporate reporting environment you will be tested on concepts, theories, principles and crucially your ability to apply this knowledge to real life scenarios.

ACCA syllabus covered in Strategic Business Reporting (SBR) September 2023 to August 2024:

- Fundamental ethical and professional principles

- The financial reporting framework

- Reporting the financial performance of a range of entities

- Financial statements of groups of entities

- Interpret financial and non-financial information for different stakeholders

- The impact of changes and potential changes in accounting regulation

- Employability and technology skills

Strategic Business Reporting (SBR) pass rates are 50% (Sep 2023).

Click here to download the syllabus and study guide for SBR (September 2023 to August 2024.)

Strategic Business Leader (SBL)

SBL mirrors the workplace and provides you with real world challenges allowing you to demonstrate a blend of technical, practical and professional skills. Work through the Ethics and Professional Skills module either before you start, or alongside your studies. This gives you insight into professional skills that you can apply in your exam and in the workplace.

ACCA syllabus covered in Strategic Business Leader (SBL) September 2023 to August 2024:

- Leadership

- Governance

- Strategy

- Risk

- Technology and data analytics

- Organisational control and audit

- Finance in planning and decision-making

- Enabling success and change management

- Professional skills

- Other employability and digital skills

Strategic Business Leader (SBL) pass rates are 50% (Sep 2023).

Click here to download the syllabus and study guide for SBL (September 2023 to August 2024.)

Optional Any 2

Advanced Financial Management (AFM)

You need apply relevant knowledge, skills and exercise professional judgment as expected of a senior financial executive or advisor, in taking or recommending decisions relating to the financial management of an organisation in private and public sectors.

ACCA syllabus covered in Advanced Financial Management (AFM) September 2023 to August 2024:

- Role of senior financial adviser in the multinational organisation

- Advanced investment appraisal

- Acquisitions and mergers

- Corporate reconstruction and reorganisation

- Treasury and advanced risk management techniques

- Professional skills

- Employability and technology skills

Advanced Financial Management (AFM) pass rates are 45% (Sep 2023).

Click here to download the syllabus and study guide for AFM (September 2023 to August 2024.)

Advanced Performance Management (APM)

You’ll apply relevant knowledge, skills and exercise professional judgement in selecting and applying strategic management accounting techniques in different business contexts and to contribute to the evaluation of the performance of an organisation and its strategic development.

ACCA syllabus covered in Advanced Performance Management (AFM) September 2023 to August 2024:

- Strategic planning and control

- Performance management information systems and developments in technology

- Strategic performance measurement

- Performance evaluation

- Professional skills

- Employability and technology skills

Advanced Performance Management (AFM) pass rates are 34% (Sep 2023).

Click here to download the syllabus and study guide for APM (September 2023 to August 2024.)

Advanced Taxation (ATX)

You’ll apply relevant knowledge and skills and exercise professional judgement in providing relevant information and advice to individuals and businesses on the impact of the major taxes on financial decisions and situations.

ACCA syllabus covered in Advanced Taxation (ATX) September 2023 to August 2024:

- Knowledge and understanding of the UK tax system through the study of more advanced topics within the taxes studied previously and the study of stamp taxes

- The impact of relevant taxes on various situations and courses of action, including the interaction of taxes

- Minimising and/or deferring tax liabilities by the use of standard tax planning measures

- Professional skills

- Employability and technology skills

Advanced Taxation (ATX) pass rates are 48% (Sep 2023).

Click here to download the syllabus and study guide for ATX (September 2023 to August 2024.)

Advanced Audit and Assurance (AAA)

The Advanced Audit and Assurance exam is designed to reflect the challenges auditors will face in their professional life. Note that the level of accounting knowledge for AAA is aligned to the SBR syllabus. Students are encouraged to sit and pass SBR before attempting AAA.

ACCA syllabus covered in Advanced Audit and Assurance (AAA) September 2023 to August 2024:

- Regulatory Environment

- Professional and Ethical Considerations

- Quality Management and Practice Management

- Planning and conducting an audit of historical financial information

- Completion, review, and reporting

- Other assignments

- Current Issues and Developments

- Employability and technology skills

Advanced Audit and Assurance (AAA) pass rates are 34% (Sep 2023).

Click here to download the syllabus and study guide for AAA (September 2023 to August 2024.)

By successfully completing these examinations, you’ll acquire a comprehensive toolbox of financial skills and knowledge that will set you apart in today’s competitive business world. With expertise in finance, law, taxation, performance management, financial reporting, audit, and financial management, you’ll be able to navigate complex financial challenges and contribute to the success of any organization.

Please refer to our Skill level FAQs Blog if you have any questions.

*Here is a chart showing ACCA Syllabus

The Unique Approach of Synthesis Learning

Synthesis Learning pioneers innovation in education, implementing a precise 4-step process covering counseling, mentoring, coaching, and placements. This strategic approach guarantees ACCA students’ thorough comprehension and professional skill development.

Watch our toppers testimonial and know how Synthesis Learning can help you achieve your goal.

Please reach out to us at 9320007893/96. We will help you design a comprehensive ACCA journey.

Conclusion

In conclusion, the ACCA Strategic Professional syllabus sets a high standard by integrating technical expertise with ethics and professional skills. By equipping students with a deep understanding of technical subjects, along with the ability to make ethical decisions and demonstrate a range of professional skills, ACCA ensures that its graduates are prepared to excel in their careers and contribute meaningfully to the business world. The real-world focus, hands-on approach, and commitment to lifelong learning further underline the relevance of this syllabus in enhancing professionalism in the workplace.

Remember, by embracing the ACCA syllabus and investing in your professional development, you’re empowering yourself to excel in the world of business and finance.