All of us have opportunities to choose between right and wrong every day; we see in the businesses around us how getting it ethically wrong can lead to serious consequences, including corporate failure, loss of reputation, fines or even jail sentences. The recent PNB Nirav Modi scam, YES Bank scam, IL&FS fiasco and PMC Bank scam have all pointed out to the same thing – that finance professionals, accountants and auditors can make or break a company’s fate by highlighting facts at the right time.

As professionals, one professes to a high standard of ethical behavior. But leaving rules and regulations to one side, who’s to say what’s right and what’s wrong? Members of the public may place their trust in you because you’re a member of a trusted professional body. They aren’t expected to know how to assess either the ability or the ethics of a doctor, lawyer, auditor or accountant. They trust that the professional bodies will do that for them. This means that as a professional you owe the public a certain level of integrity and objectivity – as well as professional competence and due care, confidentiality and professional and independent behavior.

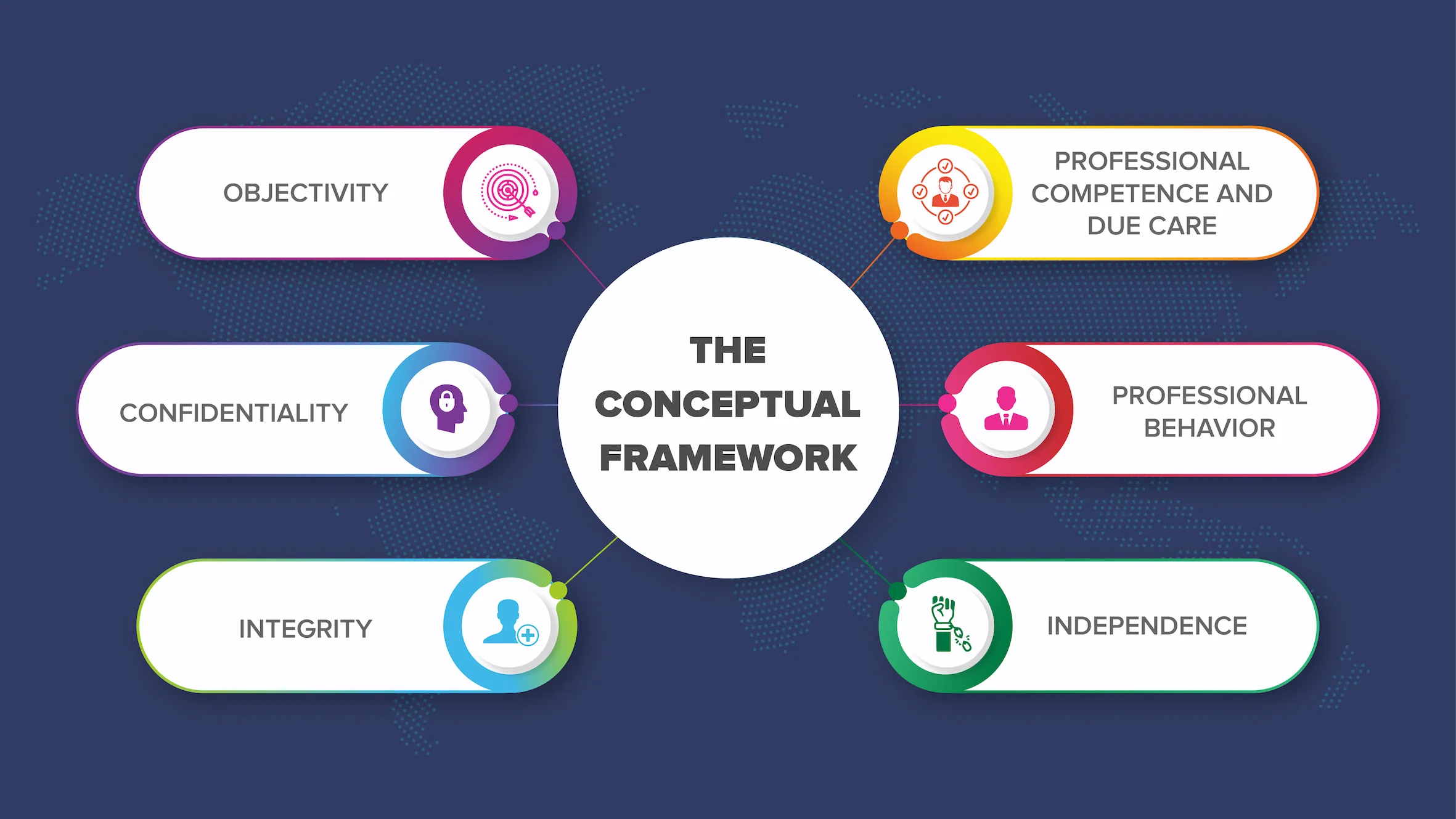

Clearly, the membership of a professional body like the Association of Chartered Certified Accountant (ACCA) requires adherence to a code of ethical conduct. The Ethics and Professional Skills module (EPSM)is an essential part of the ACCA Qualification and helps increase your employability and workplace effectiveness. The module uses realistic business simulations to develop a number of professional skills such as leadership, communication and commercial awareness. The International Code of Ethics for Professional Accountants also sets out key areas of focus and a Conceptual Framework. The five fundamental ethical principles set out in ACCA rulebook are:

- Professional competence and due care – To maintain professional knowledge and skill at a level required to ensure that a client or employer receives competent professional service based on current developments in practice, legislation and techniques, and act diligently and in accordance with applicable technical and professional standards;

- Integrity – Being straightforward and honest in all professional and business relationships;

- Objectivity – Not allowing bias, conflicts of interest or undue influence of others to override professional or business judgments;

- Confidentiality – To respect the confidentiality of information acquired as a result of professional and business relationships and, therefore, not disclose any such information to third parties without proper and specific authority, unless there’s a legal or professional right or duty to disclose, nor use the information for the personal advantage of the professional accountant or third parties; and

- Professional behavior – To comply with relevant laws and regulations and avoid any action that discredits the profession.

Why are ethics critical in accounting?

Proper ethics and ethical behavior are extremely important in accounting for a variety of reasons. To begin with, accountants and auditors are often privy to sensitive information regarding their clients, such as bank account numbers. This gives them a good deal of power in regard to their clients and it is important that the trust between an accountant/auditor and their clients not be abused. In the same way it is important that the industry itself does not become stigmatized as an unethical one, something that could potentially harm business for all accounting firms.

There can also be serious legal repercussions for those who are found to be violating legal codes and standards for their jurisdiction. We, accountants and auditors, have the unique responsibility to provide clients with professional services while presenting a truthful and accurate assessment of a company’s financial health to the general public.

Ethics is not an easy subject but one that has become critically important in a business environment in which failure to adhere to proper standards can have a devastating effect on organizations, investors, suppliers, employees and, of course, customers. Arguably, the revolution in information communications technology has meant that more people know about these issues, and more quickly than ever before, and that such events are nothing new. Perhaps this is one of the very reasons why accountants, auditors and finance professionals must constantly reaffirm their commitment to ethical values and high standards of moral behavior.